As we go through our day to day life, it’s easy to assume our children have learned the financial basics. But as they go with us to the bank or the grocery store, do they really absorb everything we want them to learn? Maybe your child is getting ready to head off to college or join the workforce. Are you afraid you’ve missed teaching them something essential? My son is still quite young, but I like the idea of being intentional with what life skills I want to teach him before he leaves the nest. I know a couple who sat down while their child was young and wrote a plan. They made a list of all the skills they wanted to teach their child before adulthood. I think I’m going to start writing my list for my son too. Here’s my list of the financial life skills that I think he needs to learn before leaving home.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

1. How to use cash and make change

Have you ever paid in cash at a local fundraiser, and watched a teenager struggle to determine the right amount of change for your purchase? I have. It made me cringe. I somehow thought that our children were better prepared for this. It turns out, with all the cashless forms of payment these days, they don’t get much experience with this form of practical math.

While they may not need to handle cash frequently, it is still something they will need to do at some time. And thankfully, this skill is fairly simple for us to teach as parents! Here are a few ideas:

Play Store

If you have a young child, play store with them. Use pretend money or real money, both dollar bills and coins. For a young child, using simple values is fine, but for older children, charge some unusual amounts for your items. If your child is the cashier, make sure they give you the right change. If you are the cashier, try giving them the wrong change and see if they catch you.

Actually use cash

For an older child or a teen, try making a few purchases in cash while you are out together. Stop for coffee or ice cream, and hand your teen your wallet. Ask them to pay with exact change. Or if you don’t like to carry coins, ask them to count the change they receive back and make sure it’s correct.

Volunteer!

One fabulous way to get real world experience is for you and your child to volunteer at a fundraiser! This is probably how I got the most experience handling cash when I was young. We volunteered in the food stand at local fundraisers for the church, for sub sales for individuals with big medical bills, and for an annual charity auction for Brethren Disaster Ministries. At these kinds of events, you probably won’t have a fancy cash register to help you. You’ll have to do the math yourself, and learn on the job.

2. Read a bank statement

A bank statement is fairly simple to read, but I think your child should see one before they are out on their own. An easy way to do this is to start a custodial bank account for your child. Deposit money to save from gifts, allowances, or earnings. You could also use an online bank to open a high-yield savings account. That way, your child can take advantage of the higher interest rates.

If you don’t want to open an account for your child or share your bank statements, that’s alright. Enter your email address to join our email list, and I’ll send you some printables to go with this article. A fake bank statement will be one of those printables for you to use. Point out the beginning and ending balance, account activity, and the page to balance your statement. I’ll admit, I don’t actually use that balance sheet, especially for a savings account. It’s usually pretty easy to see if everything is accurate without using the balance sheet. Even so, encourage your child to always look at their activity on the bank statement. Whether it’s a paper or digital statement, don’t ignore it. Your statement can be the best way to pick up on fraudulent transactions quickly.

3. Write a Check

I know we don’t use checks as much as we used to, but sometimes you still need one! Some small businesses don’t take credit cards. And it’s pretty common to write checks for gifts, as well as to track your payment. Since we don’t use checks as much, it’s even more important to intentionally teach this. Our children probably won’t pick up this skill by watching us, since we don’t write checks out very often.

I was taught to always write checks in cursive… that’s pretty outdated advice. But you should still write in blue or black ink. Point out the line for the date and for the recipient of the check. Explain that the amount is written in words first, and then in numbers. Explain why, for security reasons, after writing the amount in words, you should always put a line to the end. Point out the signature line, and the optional memo section. You can also flip over the check and show the signature line there. Explain that you need to sign the back of a check you’ve received before depositing it.

Get some free printables of checks for your child to practice. Just sign up for the email list and get the bundle of printables for teaching your child about financial life skills.

4. Balance a Checkbook

Even if you don’t write many checks, you probably have a checking account that you use often. Between direct deposits, ATM or debit card use, or online transactions and bill pay, you probably have a lot of activity in your checking account. It is important to regularly balance your checkbook, so you know how much money you have available to spend.

You can use that balance sheet that comes with the bank statement, but I generally don’t. First, I go online and compare my account activity against what’s written in my checkbook. If there is something online that I missed, I add it to the checkbook. Then, I take the balance from my checkbook and add in any expenses and subtract any deposits that aren’t listed online yet. The number I get should equal the balance listed online. I prefer to balance my checkbook this way, because I can balance it whenever I want. Whenever I have time, or want to know exactly what’s in my account, I can balance it. I don’t have to wait for a new statement to arrive.

5. How to write a deposit slip or deposit a check

These days, you might make your deposit in person at the bank or online. I want to teach my child both ways. Next time you make a deposit, simply show your child what you’re doing. If they are making deposits into their own account, let them fill out the deposit slip themselves.

6. Use credit cards to build a good credit score (NO DEBT!)

Even if this is an area where you are struggling yourself, that doesn’t mean you can’t teach this to your children! You don’t have to have perfect credit to talk about this subject. In fact, sharing your failures as well as your successes can make the importance of using credit cards wisely more clear to your children.

The key to building a good credit score is to use credit and then pay off the balance in full every month. Always pay on time and always pay in full. There is no benefit to carrying a balance, and credit card debt can get out of control quickly due to high interest rates. Length of your credit history can also have a big impact on your credit score when you are just starting out. You have to be 18 to apply for a credit card, and if your child doesn’t have income they may need to wait until 21 to get a credit card.

Can my child build credit history before age 21?

If your child is an authorized user on your credit cards, that can actually build credit history for your child. Be cautious with this approach, though. If you as a parent are struggling to make on-time payments, this could reflect poorly on your child’s credit score as an authorized user. It may just be better to wait and let your child build their credit score on their own.

If you Moms and Dads need some help to get your credit card debt and credit score in control, check out these articles:

7. Understand a Credit Card Statement

This is another simple one, but also good to see before you’re on your own. To me, the two most important things are your activity, and the last statement balance vs minimum payment. First, I always check my activity each month to make sure there is no fraud. Second, draw your child’s attention to the difference between the statement balance and the minimum payment. If you only pay the minimum payment, you’ll never pay off the debt. You’ll be making the credit card companies very rich. Instead, always pay the last statement balance in full every month.

8. Budgeting

If you have a budget, please share it with your child. And if you don’t have a budget, make one and talk about it with your child. My parents were fantastic budgeters! But they were very private about their finances. When I got out on my own, it felt like I was starting from scratch. I knew a budget was important, but I didn’t know how to set one up or how much I should be spending. Thankfully, I stumbled upon a budget spreadsheet that got me started. Over the years, I’ve made my own budget spreadsheet to include all the sections that I want, to more easily see what I’ve spent and how much I have left over. You can get started with my budget spreadsheet too! It’s free and easy to get started. Just enter your email below and I’ll send it to you.

If you need some help making a budget, or just want more info to help as you talk with your child, click here.

8. Understand how loans work

Unfortunately, our children will are likely to have to make decisions about whether to not to take out a loan at a very young age. And a poor decision could impact them for many years to come. Per this article on CNBC, the average 18 to 23 year-old in the US has $16,043 in debt, with each carrying an average of $1,963 in credit card debt. Credit cards, student loans, car loans: they’ll need to be ready to make the right decision.

Interest rates

The best way to start is to learn about interest rates, and how interest compounds over time. When you are earning interest in a bank account, compounding interest is a good thing. But when the compounding interest is on debt, that’s a different story. If you don’t know where to start, look up an online interest calculator. Take a look at how much it will cost you in interest when you use debt to make a purchase. Compare high vs low interest rates. Explain that high interest rates are a part of the reason that credit card debt can be so dangerous. With a high interest rate, it is harder to pay off a debt.

How long will it take to pay off?

I think that a lot of people who take out student loans don’t fully understand it will impact their lives. I know I didn’t. Teenagers don’t have a reference for how much $200 or $700 is. They likely haven’t had full-time income or paid household bills. Compared to the salary that they may be expecting, it may not sound like too much. But subtract out the taxes, rent or mortgage, utilities, auto costs, and other expenses. We all know that the finances can get tight pretty quickly.

Our job isn’t to stop them from pursuing their dreams, but to help them understand the impact of their decisions. If my son is passionate about a field that requires a graduate program, then I want him to do it! But I also want to show him how the high costs of attending graduate programs will affect his future. I want him to understand how long it might take to pay the student loans off. He needs to go into it with eyes wide open, so he can decide well as he plans and prepares.

What I wish my family had told me

I got my doctorate in order to practice in the field I wanted, but I’ve sometimes regretted that decision. I feel that I didn’t really know what I was getting into, and I think my family could have helped. Maybe they thought I already knew these things… I was good at math, after all. But I didn’t. Here’s what I wish they would have told me:

You may have an $800/month loan payment after completing a graduate program. That is roughly as much as rent or a mortgage in this area. It is a lot of money!

Either you will need to work hard and live poor for a while to pay off your loans, or you will be paying them off for a looong time.

Apply to more scholarships! It doesn’t matter how many turned you down. College is really expensive.

No matter what school you go to, you will be a PT. Choosing a cheaper school, living at home and commuting, or doing your first years at community college will save you a lot of money. It may not be your ideal college experience, but it will make your life after college easier for many years to come.

Please know that my family is also the reason that the only debt that I have today is my mortgage. They have been financially supportive and have taught me a lot about managing finances well. But I think that a lot of parents today have a different understanding of student debt, and it will be helpful if we can purposefully share these perspectives with our children.

9. How to choose an insurance plan

I don’t know about you, but I still get a bit overwhelmed at times when looking at insurance documents. Start with the basics: premiums, deductibles, and coverage. In general, lower premiums will mean higher deductibles or less coverage. Talk with your child about how to weigh which is best.

Car Insurance

The first kinds of insurance your teen will likely need would be car insurance. I would encourage them to have more than the minimum, as a teenager or young adult starting out doesn’t likely have savings for anything that is not covered. Also, if your teen doesn’t already know, tell them that different car makes and models can have very different insurance rates. Sports cards, luxury cars, and electric vehicles generally have the most expensive insurance rate. The best way to know is to call your insurance company when considering a car purchase and asking what the rate would be for the different vehicles you are considering.

Health Insurance

Eventually, they may get health insurance offered through work. Not all health insurance plans are created equal, and the best plan when you are an older adult is probably not the best plan for a young adult. If you aren’t quite sure how to choose the right health insurance plan, head on over to my article all about different types of plans. Now, my healthcare coverage is easy since I use Christian Healthcare Ministries, so if you don’t like your plan, check them out.

Other types of insurance to discuss

At some point in the future, your child will need life insurance and homeowner or renter insurance. I won’t go into too much detail, but I do have a few tips. First, check out renter insurance. You may even get it for FREE if you can get a mutipolicy discount with your car insurance. In fact, our bill went DOWN when we added renter insurance. Second, whole life insurance is not a good “investment”. It is a life insurance plan, and it does carry a cash value that grows over time. However, your money will perform better if you simply invest it in a retirement plan or the stock market. There are reasons you may want a whole life insurance plan, but do not think of these plans as investments for your future. Consider simply purchasing term life insurance for much cheaper and investing the money you saved.

10. Generosity

Generosity is so important. I believe it is key to breaking money’s power over us. There is nothing wrong with having money, but we’ve all seen people who focus too much on the pursuit of money. You can buy good things with money, but if money is our focus it won’t bring us happiness or contentment.

Sometimes I struggle with fear, fear of not having what I need for my family. It makes me worry about having enough money. But when I give, I focus on the needs of others and it gives me a more balanced perspective. I guess it helps me get out of my own head, in a way, and to see how blessed I have been. And I have seen how God has worked through life’s circumstances and through others to meet our needs in times of difficulty.

11. How to spend less on groceries and clothing

For my tips, check out these articles on salvage grocery stores and saving money on meat.

12. Recognize a scam

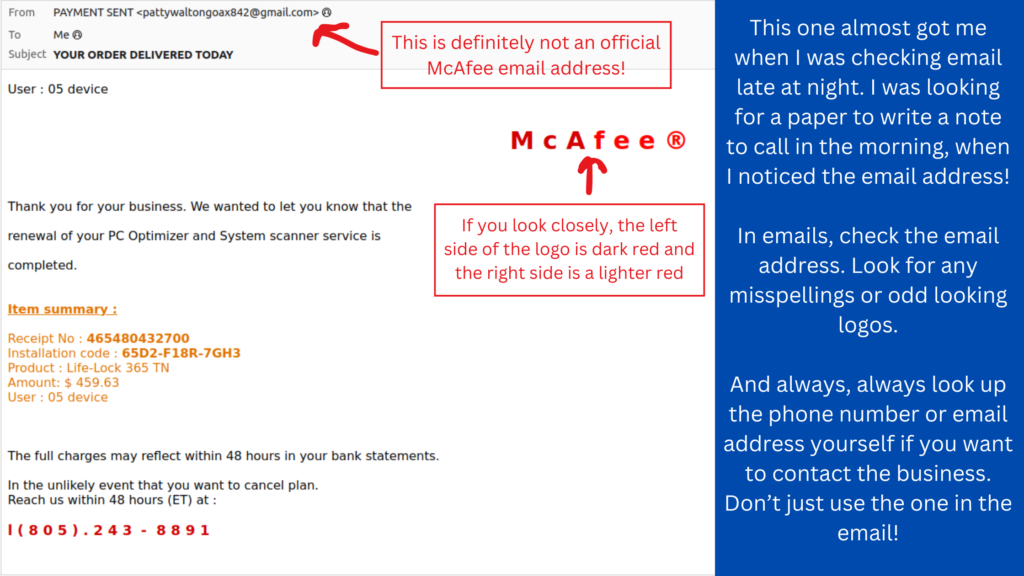

We’ve all had plenty of scammers call, text, and email us. Teach your children from a young age to recognize a scam. Watch for spelling errors or unusual email addresses. The scammer will usually make it seem very urgent, and they could ask for money, gift cards, or personal information. A scammer may promise to give you something in return, after you have sent them the money. They may even claim to be from a company you know. Don’t give out personal information if you are not sure. If you are worried, hang up the phone or close that email or text, and look up the contact information for the company. Then, contact them yourself. And remember, if it’s too good to be true, it probably is!

13. How to save and invest

From a young age, we can start teaching our children about the benefits of saving. However, as they get older, they need a bit more detail about types of savings and investments.

Savings Accounts

In addition to a regular savings account at a brick-and-mortar bank, your teen or child can consider a high-yield savings account. They can get higher interest rates, and often have the same protections for their money. Just make sure the bank is FDIC-insured. Savings should include an emergency fund as well as saving for future purchases such as electronics or a vehicle.

Emergency fund

As soon as your child gets out on their own, they should have an emergency fund. An emergency fund should be enough to cover 3-6 months expenses. I’m sure you have a few examples in your life of when you needed an emergency fund, or maybe wished you had had one. Share those experiences if you’re comfortable, so your child will understand the importance. For more info, check out this article.

CDs

Certificate of Deposit (CD) rates weren’t so good for a long time, but with the recent rise in interest rates they are a good option for savings again. Your child should understand what a CD is, and when they might use one. In particular, a CD can be a great option for money you don’t need right now, but will need in the next few years. For example, if your teen is saving for a car but won’t be able to get their license for another 3 years, a 3 year CD with a good interest rate is a great way to grow that money.

Retirement Investments

There’s a lot you could discuss with your child about investing for retirement: how much you need, types of retirement accounts, financial advisors. It is probably enough to start to just discuss the importance of starting to invest for retirement as early as possible. A small amount invested early can have a big impact.

If you are still looking for more ideas for teaching your teen the financial life skills they will need, this article focuses on teaching teens about money by doing. There’s no better way to learn than through practice and experience!