When I was looking at colleges, I chose the more expensive private college. My reasoning was that since I had a good scholarship there, it wasn’t THAT much more expensive than the other school. Besides, it was a great school, and the outlook for my chosen profession was great. What I didn’t have when I made that decision was life experience. I didn’t realize that it would be hard to pay my student loans off early. Until I wanted to purchase a home, I didn’t realize how much my loan payment limited our monthly budget. And I consider myself lucky, because I did have scholarships and a family who was able to help with some of my college costs. If you are making those decisions right now, I’m going to share my real life experiences with you. Chase your dreams, but make your decisions with your eyes wide open and all the information.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

Real Life After College, with Student Loan Debt

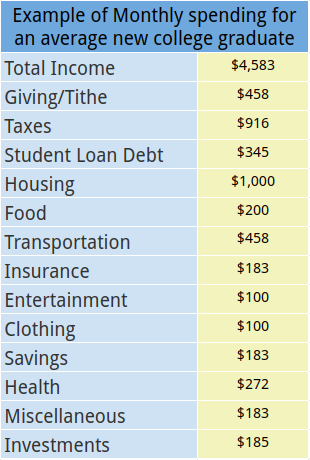

The average debt for a student who took out loans for a bachelors degree is right around $30,000. As of today, the interest rate for Federal Direct Subsidized and Unsubsidized loans for undergraduates in the USA is 5.50%. You can find updated, current rates here. Using the Student Loan Simulator, our student would pay $345 per month for 10 years to pay off their total of $30,000 in student loan debt. The average salary for a new college graduate is about $55,000. Now let’s see how that $55,000 gets spent. Here’s an example of monthly spending for our average new college graduate:

You can survive with student loans

If you add up the values in our chart up above, our college grad is living within their means, with a small amount going to savings, investing, and entertainment each month. As a new college grad with the average salary and average amount of student debt, you will be able to pay your bills. Of course, everything varies based on where you are living. In my area, you can get a small, older 1 bedroom apartment for $1,000 per month including utilities. In other areas, it may be impossible for you to afford housing without the second income of a roommate or spouse.

With $30,000 in student loans, that $345 per month payment will continue for the next 10 years, But, we have plans for the next 10 years of our lives! We want houses, families, nice cars, vacations. Can a new college graduate afford that with student debt?

Student Loan Debt Limits You

The hard truth is that having student loan debt will limit your choices. With our example, more than $4000 per year that is tied down to paying off debt. You may not be able to do all the things you planned. Some things will have to be put off for years until you can afford it.

Vacations

Even if you are working to pay off debt, I think you should still take a vacation now and then. We need the rest for our minds and bodies. You likely won’t be able to afford a big international trip, though. Frankly, on a $100 per month entertainment budget, you’ll be having stay-cations and day trips for a while.

Buying a new car

That $458 in the monthly spending chart above isn’t just a car payment. The category includes the cost of gas and maintenance. You won’t be affording a new car on this budget. Purchasing a shiny, new car with all the bells and whistles will have to wait until the debt is paid off. The best strategy is to get a used, budget-friendly car and get it paid off quickly. It’s even better if you can buy that budget-friendly car from your savings, and avoid the car loan.

Buying a home

I’m not saying it’s impossible, but I will say it would be very difficult to afford a mortgage payment on this budget. But that’s not actually your biggest challenge here. You should have at least a 10% down payment for your home, and for a $200,000 home, that’s $20,000. It takes 9 years to save $20,000 when you can only put $183 per month towards savings, as in the example above. If you didn’t have student loan debt, you could put all that money from your loan payment into savings as well. Then, you’d have $20,000 in just over 3 years. That’s a big difference.

Having children

There’s no doubt about it, children are expensive. Not only that, many couples would prefer having a 2-3 bedroom house or apartment before having children. That’s another additional expense. It’s no wonder so many people who want children are waiting longer these days.

Dream Wedding

With our monthly spending example above, you will not be affording a large, fancy wedding. Friendly reminder: You should never go into debt for a wedding. We’ve just been examining how much debt can limit your life. You want to have good memories of your wedding day. Don’t look back later and wish you weren’t burdened by the extra debt.

Starting a Business

Ever dream of working for yourself? Depending on your start-up costs, starting your own business may have to wait until your debt is paid off. It will be harder for you to save money while paying student debt. If you try to get a loan to start your business, it will be harder for you to be approved, and you might pay a higher interest rate.

Less Saving for Retirement

We’re all told that it’s important to save early for retirement. What they don’t share is that it will be hard and downright impossible at times. When you are young and starting out, there are a lot of expenses. You’re making an entry-level salary. You likely won’t have a large amount of savings to fall back on yet. If you have less student debt, you’ll be able to contribute more to retirement earlier. My recommendation is to just do the best you can, even if it doesn’t feel like much sometimes. It really does add up.

Education or Certifications for advancement

Maybe you want to pursue a Masters degree or a specialty within your field that requires more training or certification. You may not be able to do as much as you want right away simply because of the cost. Perhaps you can work through it at a slower pace, spreading courses out over time to keep cost down. Maybe you need to delay your career goals for a time.

If you need student loans for the career you want, here are your options:

First, you could take out the student loans and make the minimum payment each month.

Stay the course, living a life limited by debt until you finally pay off your student loans. In our example, that would be in 10 years, when you are about 28 years old. There’s nothing wrong with this, but I think most of us have bigger plans for our 20s.

Another way is to do everything in your power to take out less student loan debt.

Work more hours if you can. Choose a cheaper school. As a director I was responsible for hiring, and I can tell you that I did not care at all what college the job applicants attended. Live at home, attend a local school and commute if you can. This is what I wish I had done. I lived close to my college and I could have commuted, but I wanted the college experience. In hindsight, the college experience would have been just fine as a commuter. And I don’t think that college experience is worth the limitations of debt for years to come.

Finally, you can work hard, live frugally, and pay off your student loans early.

Do what you can to keep expenses low and throw every extra dollar at your debt. If you have the opportunity, live with your parents a bit longer for lower living costs. Pick up extra work and put that money towards your debt too.

A few other tips:

Make sure you have 3-6 months of expenses in an emergency fund. While we don’t know what or when, we do know that eventually something unexpected will happen. You don’t want to go into more debt or miss payments if you suddenly have an emergency or loss of income. Build up an emergency fund while making the minimum payments on your student loans. Then, when you have an emergency fund, you can start putting extra towards your student loan debt.

Don’t go into more debt – no credit card debt, no personal loans. Try not to take out a car loan unless you really have to. If you do need to buy a car in order to get to work, and you can’t afford to buy it without a loan, then make sure you buy the most budget-friendly car possible. If you want to buy a home, a mortgage is a “good” debt so you can do that any time. You will be paying housing costs anyway. And the home will have value to it that usually grows over time, so you shouldn’t ever owe more than the home’s worth.

To sum it all up:

Here’s a brief summary of 8 ways in which student loan debt will impact your day-to-day life:

Financial Stress

- Worry and anxiety about making loan payments

- Strain on your relationships as you and your significant other make difficult financial decisions, with student loan debt limiting your options.

Limited Disposable Income

- Less money for hobbies, entertainment, eating out

- Less money for traveling

- May need to cut back on spending in many areas to live within your means

Delay Major Life Plans

- Put off buying a home until you can afford mortgage payment and down payment, as well as home maintenance

- Delay starting a family until you are in a better financial position or have a bigger home

- Might be unable to afford dream wedding

Limited Career Choices

- Feel pressured to choose a higher paying job over a job you love with a lower salary

- Difficult to start a business

- Less ability to pursue further education or certification to further your career

- Feeling trapped in a job you don’t like because it offers loan repayment/forgiveness benefits

Difficulty Saving

- Harder to build an emergency fund and cover unexpected expenses

- Less ability to contribute to retirement early

Credit Score Impact

- High student loans can affect your debt-to-income ratio, lowering your credit score and making it more difficult to get approved for car loans or mortgages. May have higher interest rates for loans, or require a higher deposit for utilities or apartment rental. Read my article about credit scores for more information.

Healthcare

- May be harder to afford health insurance

- Worry about ability to afford medical costs may lead to putting off necessary healthcare

Mental Health

- Debt is associated with higher stress and higher likelihood to develop mental health conditions. This is true of student loans too. Check out a summary of the research here.

- May be more isolated from friends if you are unable to afford dining out or entertainment like them

Please, don’t be scared by this list. It is here to help you make the right decision for you, but the right decision for you may involve student loan debt. While I would have done it differently if I was making the choice again, I can tell you that it has still be a beautiful 8 years since I graduated. Sometimes the things I thought I wanted didn’t work out like I expected, so I’ve had to try again. I’ve been learning and growing, and I can still find joy in all the parts of the experience.