Budgeting is Key for Financial Freedom

A budget is the starting point on your journey to financial freedom and peace of mind, and it’s easy to get started with this step by step budget guide. Now, I know what you are thinking: “A budget is restricting, not freedom. I don’t want a budget telling me what I can and can’t do”. Wrong! The budget is not the restriction – the truth is that the restriction is your money situation, friend. Your budget is simply a tool that helps you see that money situation clearly, plan ahead, keep track of and prioritize where that money is going. Consider the following scenarios:

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

Scenario 1:

You don’t budget because it limits you; you just want to be free to spend your money how you want and have a good time. During a fun evening out with friends, you realize you aren’t sure how much is in your account. You worry that your credit card will be declined or that you will overdraft your bank account. It would be so embarrassing for your friends to see that you are broke and to have to borrow money from them this evening. How will you ever be able to pay them back? You’re already in debt and basically living paycheck to paycheck.

Does that sound like freedom? Definitely not.

Scenario 2:

You follow this step by step budget guide to create a budget and you stick to it, making sure you live within your means. Although that means cuts in some areas of your life, your budget prioritizes going out twice a month because spending time with your friends is important to you. You go out for a fun evening with friends, and you know exactly how much you can safely spend that evening. Also, there is no way you will be embarrassed by a declined credit card or hit with overdraft fees because you are now living within your means and have savings! Sounds like a much more enjoyable evening to me, and all thanks to the peace of mind that comes from BUDGETING!

So let’s dive in to the Step-by-step Budget guide!

Step 1: Write Down Your Expenses

The first step isn’t actually making a budget. Instead, it’s figuring out where your money is going right now. In particular, find out how much your fixed expenses are, and also begin tracking your income and expenses. You need to find out:

Average Annual or Monthly Income

If income is irregular or seasonal, use an average for your budget. With irregular income, you may want to consider a larger emergency fund. If you don’t have an emergency fund yet, learn how to set one up and why you need one with this article.

Fixed Expenses

- Mortgage/Rent

- Medical Insurance

- Car Insurance

- Phone Bill

- Debt Repayment

- Tax Deductions

- Internet

- Cable/Streaming Services

- Other Subscription Services

Variable Expenses

- Groceries

- Gas

- Car Maintenance

- Home Maintenance

- Clothing

- Cleaning Supplies

- Medical Expenses

- Electric

- Gifts

- Eating Out

- Vacations

- Toiletries

You can categorize the variable expenses in whatever way it is easiest for you. Some people like more detailed categories, and others like me prefer a broader category. Truly, the best way to budget is whatever method that keeps you USING the BUDGET. It doesn’t matter how perfect your budget is if you stop using it partway through the year because it was cumbersome or difficult to use.

The Easy Way to Track Expenses

When I was little, my mother would save receipts in order to track spending and keep the budget. We’d be playing in the living room and she would have the floor covered in notebooks, coupons, and receipts. Thankfully for us, we don’t need to do that anymore. There are many budgeting apps that allow you to track your expenses.

I prefer to keep a budget spreadsheet on GoogleSheets. This spreadsheet includes areas to track expenses in each category every month, as well as the budget. My husband and I can both easily access it from our phones and computer. When we’re standing at the gas pump or right after a purchase, we can just quickly type in the cost. Quick, easy, and no pile of receipts! My Budget Spreadsheet is available to you for free, because I want to make this easy for you too. It is already set up to do all the calculations you need, with sheets that allow you to see at a glance your annual spending or funds remaining in each category. The budget categories are also fully customizable.

Weigh Your Priorities

Once you have decided what kind of budget you want – app, spreadsheet, or good old-fashioned paper – it’s time to start writing down some numbers and making decisions. Your budget needs to balance, or you will be digging a bigger financial hole for yourself each month. If you punch in the numbers and they don’t work out, it’s time to make adjustments.

Consider what is most important to you, and what items are a lower priority. Decide if these lower priority items can be cut out for now, knowing that you are working to be debt-free and can enjoy those things again in the future. Try to continue to allow yourself some small pleasures, whatever that may be for you. My coworkers prefer to have takeout from time to time, whereas I would rather give up eating out entirely in order to be able to get away for a vacation (even if it’s a small, local trip).

If there is no further way to tighten the belt, and you are still in the red, it may be time to think about any ways that you can add income or reduce expenses. Can you make a small income on the side, or take on additional hours at work? Would you consider selling a car to reduce expenses and do without? Is it time to look into resources in your community that can provide assistance?

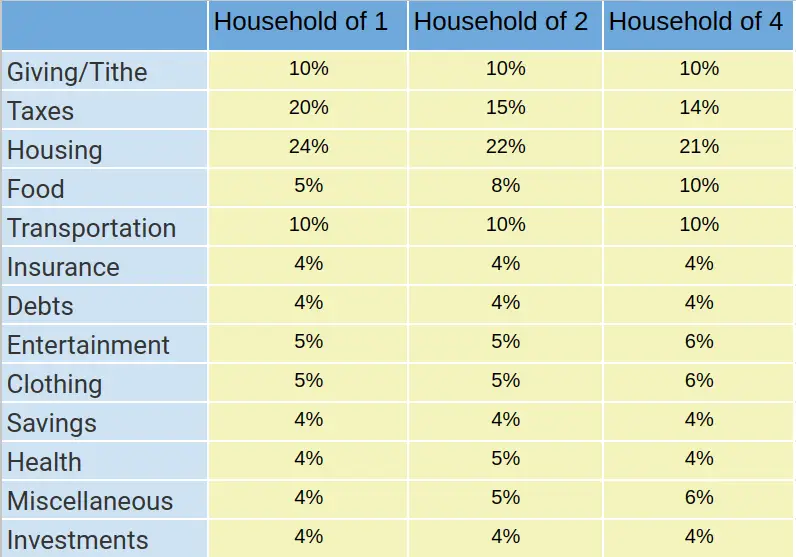

Budget Recommendations

I’m going to give you a few guidelines for how much you should allocate to certain areas of your budget, but first I want to make one thing clear. You should not feel bad or think you are doing it wrong if these guidelines do not work for you. Income level and taxes, home prices, rent and cost of living vary widely across the USA, and I’m sure that is also true for my readers in other countries.

You may have also seen many other recommendations including the 70/20/10 budget, the 60/40 budget, the 50/30/20 budget… the number of options out there can be pretty overwhelming. Don’t get bogged down with all of the different recommendations. Think of the guidelines I have listed below as a starting point. Know that you will likely need to make adjustments to meet your individual needs, and that is 100% OK

Savings

Everyone should have savings in their budget. It doesn’t matter if you can’t save much per month right now, the important part is that you start. Where that money you are saving goes will depend on where you are at in your financial journey.

Step 1: Emergency Fund:

You should work to build up an emergency fund that covers 3-6 months of your expenses. This is the first step, because an emergency fund can keep you from going further in debt if you run into unexpected income loss, home repairs, breakdowns, etc.

Step 2: Consumer or student debt (this does not include your mortgage)

Once your emergency fund is established, use additional savings to pay extra over and above the minimum payment to get rid of those debts. There are different methods of debt payoff, like the snowball method. Without a doubt, the right method is the one that keeps you motivated and on track so you get out of debt. If you feel like you are in a deep hole and you need the motivational boost, then pay off the smallest debt first. However, it is also just fine to pay off the debt with the highest interest first, even though it may be your largest debt. Either way, it’s a win!

Why don’t I include the mortgage in this category? Your mortgage does carry interest, and it would certainly be great to have it paid off. However, unlike car loans or personal loans, a mortgage is generally considered “good debt” because real estate maintains its value and generally has increasing value over time. If something unexpected were to happen, you could sell your home and the sale would cover the mortgage. On the other hand, if you bought a car with a loan and needed to sell it shortly after, you would likely have debt remaining after the sale of the car, as the value of the car would have decreased over time.

Step 3: Investing and Building Savings

Do not begin investing until consumer debt is paid off. The return on your investment is likely going to be less than the interest on the debt. Even if you do happen to have some introductory rate 0% APR loans, I would still pay off consumer debt first because an investment is never guaranteed success, whereas your debt is guaranteed to stick around until you pay it off. The exception is employer-sponsored retirement plans with an employer match. I would contribute enough to the retirement plan to get the full match (hey, it’s free money!) if you are able, but I wouldn’t contribute any extra until you have your debt paid off.

After all consumer debt is paid off, start using that extra money for:

- Additional retirement savings

- Savings for future car purchases to that you don’t ever go back into debt again.

- Savings for home renovations, big ticket items, or children’s education

And now you finally have your first budget!

Thank you for using my Step-by-step budget guide! I hope that this information was helpful for you. Please, remember that this budget is a tool to HELP you. It is not a restriction, but you do need to check the budget frequently and track all expenses in order for it to be helpful. If something isn’t working out with your budget categories as you begin to use it, make adjustments. Just remember to stick with it, and to be sure to spend less each month than you make. The progress may seem small at first, but it adds up!

Do you have any questions, comments, or budgeting stories you would like to share? Comment below or email me at Sarah@HappyBluePig.com. I would love to hear from you!